With many stock market indexes nearing all-time peaks, the wealth and asset management sector are under regulatory oversight. Businesses are searching for more effective solutions to combat Anti-Money Laundering (AML) and financial fraud. Compliance with AML, Know Your Customer (KYC), and penalties laws remain a top priority for management. Firms are under pressure to demonstrate that they have robust compliance systems in place to fulfill regional and worldwide regulatory obligations.

With the world's total assets under management expected to rise from $110 trillion in 2020 to $145 trillion in 2025, regulatory monitoring is likely to grow, with greater penalties and fines for noncompliance, deferred prosecution agreements, and focused fulfillment for AML and sanctions misconduct.

Like any other form of business in the financial services industry, asset management organizations are subject to stringent money laundering and terrorism funding regulations.

AML compliance of Asset managers in Europe

The European Union (EU) continues to broaden the scope of its anti-money laundering rules. The 5th Anti-Money Laundering Directive (5AMLD), which went into effect on January 10, 2020, increased the criteria for:

- Customer Due Diligence

- Individuals with domestic and political exposure

- Beneficial ownership central registrars

The EU has already enacted the 6th Anti-Money Laundering Directive (6AMLD), which requires companies in all member countries to adopt the new requirements by June 3, 2021.

A Risk-based Approach to Customer Onboarding

Taking a risk-based approach to compliance is an essential factor. With technology and money laundering strategies evolving at such a rapid pace, exact imposing rules becomes difficult. As a result, the EU approach is more focused on developing systems and attitudes that are more likely to be effective in the long run. The EU approach considers concerns such as, "Do you know who your client is, how they receive their money, and what hazards they pose?" What are your risk management practices, and how do you analyze and maintain them? Developing adaptive processes will aid in the protection of your business from undesirable actors.

AML Solutions for Investment

AML compliance is easier than ever for the Investment Industry.

Learn MoreThe Future of Anti-Money Laundering Compliance for Investment Advisors

With the passage of the National Defense Authorization Act of 2021 (NDAA) and rule revisions proposed by the Financial Crimes Enforcement Network, highly regulated financial businesses operating in the United States are experiencing substantial anti-money laundering (AML) legislative and regulatory reforms (FinCEN). As a result, SEC-registered investment advisers, hedge funds, and private equity companies have been exempt from AML rules.

Historically, these businesses have not been obliged to comply with the Bank Secrecy Act (BSA) because investment firms are not included in the BSA's definition of a "financial institution." While the NDAA includes certain amendments that affect investment companies, including involving the disclosure and registration of Ultimate Beneficial Owners (UBOs), the legislation is quiet on more specific AML requirements for these kinds of organizations.

What Exactly is Client Onboarding in the Asset Management Industry?

C lient onboarding refers to the steps that must be completed when a new client expresses an interest in working with a financial advising business. Client onboarding procedures include the following:

Prospecting – The product selection

Legislative checks

New account opening (NAO)

Wealth management onboarding entails the first meaningful encounters between an adviser and an investor, and it builds the framework for a long-term customer experience.

Customer onboarding has traditionally entailed a lot of time-consuming manual documentation. Still, many broker-dealers and other wealth management organizations are digitizing and automating the process to enhance the customers' experience and save money.

Compliance with the Regulations

Both regulators and law enforcement have highlighted AML risk in the investment firm sector. Although many suggested changes may codify current processes for many businesses, companies must plan ahead of time for the possibility of heightened regulatory oversight. Firms should consider strengthening their Anti-Money Laundering (AML) systems to assure that thorough Know Your Customer (KYC) practices are in places, such as enhanced customer identification programs, strong Customer Due Diligence processes, and Ongoing Customer Monitoring that involves sufficient background searches and adverse media monitoring, as appropriate. Firms may want to consider focusing on a single customer perspective to ensure proactive and comprehensive customer risk monitoring.

While many investment firms have expertise in harnessing alternative data sources to make business choices, using technology to acquire data may also help with AML compliance procedures. Artificial intelligence and machine learning enable businesses to automate compliance procedures and proactively identify hazards across various data sources, including customer data, transactional data, and open-source data. In summary, making an early investment in RegTech can result in significant future profits.

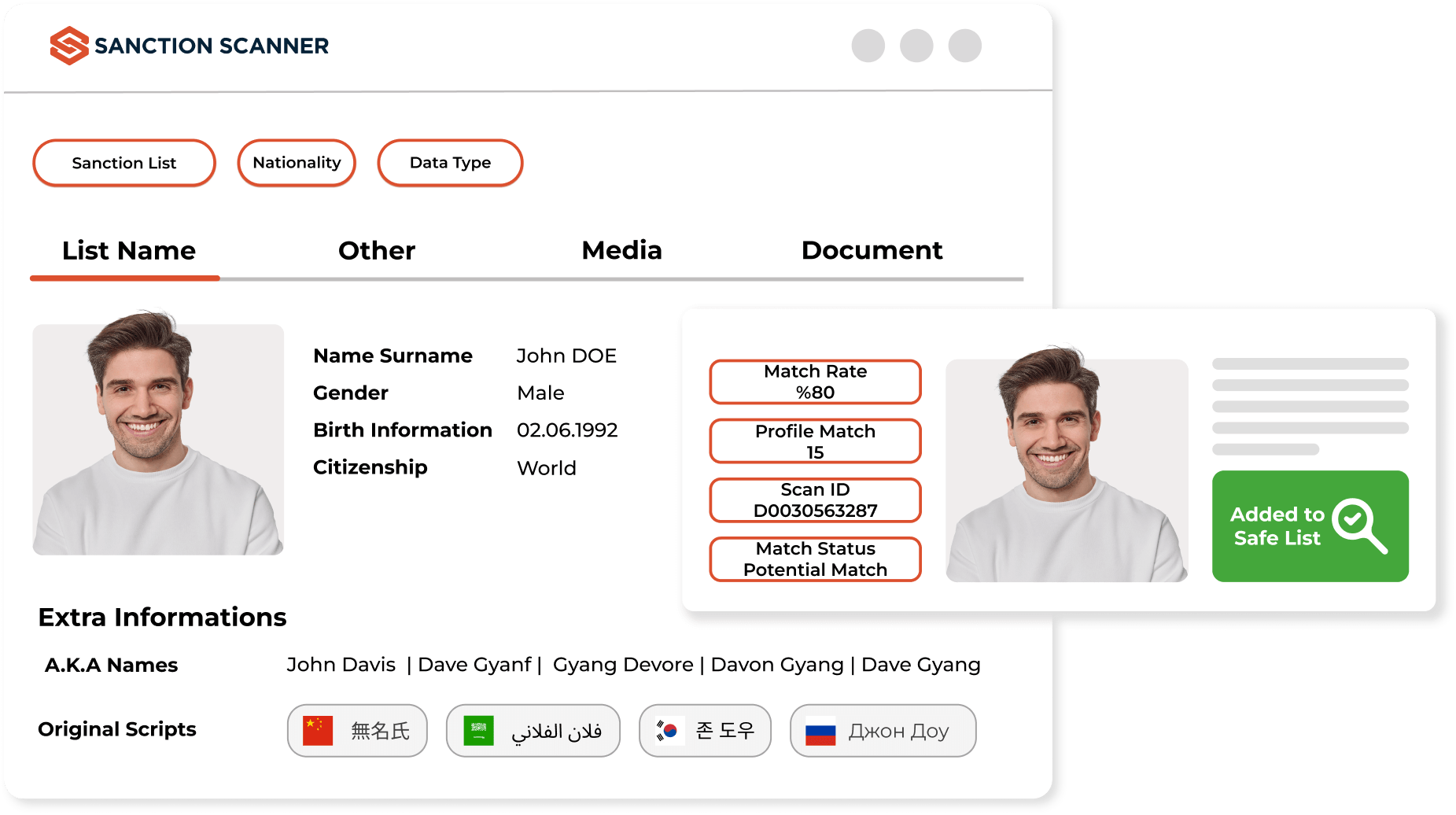

Sanction Scanner's solution for the Investment & Asset Management business enables you to quickly onboard customers by instantaneously screening them against worldwide databases, finding potential dangers and connections, and receiving contextualized updates from our adverse media analytics machine.