If you are an institution that mediates many transactions a day, such as a bank, you should be aware that financial crime risks may occur in transactions. It is necessary to understand these risks and to monitor transactions constantly. For this reason, our artificial intelligence-supported AML Transaction Monitoring tool offers beneficial solutions to financial institutions.

With Sanction Scanner AML Transaction Monitoring , organizations check the transactions they mediate and receive alarms in case of high-risk and suspicious activities. Institutions can create their own rules and scenarios without any coding knowledge. Besides, they can test the rules without going live, according to the rules they have determined. How Does? You can get detailed information about AML simulation in Transaction Monitoring by clicking the link below.

Importance of Simulation in AML Transaction Monitoring

Although our AML Transaction Monitoring solution has many different and effective features, what we will be talking about today is the Customer Scorecard. If you want to understand what Customer ScoreCard is, its importance, and how it works, keep reading!

Understanding of Customer Scorecard in AML Transaction Monitoring

We have mentioned that institutions that intermediate many transactions should check against risks such as money laundering. These organizations may want to know their risk levels to reduce measures. In this case, each institution's risk understanding also feels to determine its own risk criteria according to its own risk understanding. In this case, Sanction Scanner AML Transaction Monitoring helps the organization when it needs it.

With AML Transaction Monitoring, you can determine some criteria according to your customers' job, age and income and assign scores according to the stages of these criteria. You can assign people alarms such as low, low, medium, high, critical according to these scores. According to the alarms you receive during the process, the transactions can easily decide the action steps. It is difficult to comply with AML, especially if you are an institution that mediates many transactions in a day but remembers that you can prevent these crimes by using technology. You can easily comply with the regulations.

How Does Customer Scorecard Work?

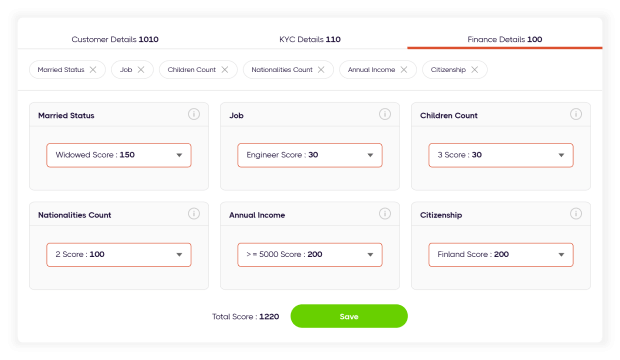

You can set some criteria to know your customers' risks and determine their risk levels according to these criteria. For example, you can determine your client's criteria such as annual income, account type, job, married status, children's count, Citizenship under 4 main categories (Financial Details, Customer Details, KYC Details, Additional Risk Factors). The criteria are purely exemplary and remember that you will set them.

Afterward, you can make risk scoring in Score Card Fields for these criteria. You can enter the score you want; for example, let's say you scored based on your client's job. You gave 100 scores for a politician's risk score, 30 for the teacher's score, and 10 for the student. At this point, you know that a politician has a higher risk score, so there are potential crimes that can happen in their commitment.

After the customer determines the Scorecard, when you enter your customers' information, you will see the risk scorecards with your own criteria and scoring. As a result, you can apply multiple criteria. Sanction Scanner AML Transaction Monitoring Customer Risk-Score Cards are dynamic and can easily respond to the organization's needs.

Customer Scorecard Case

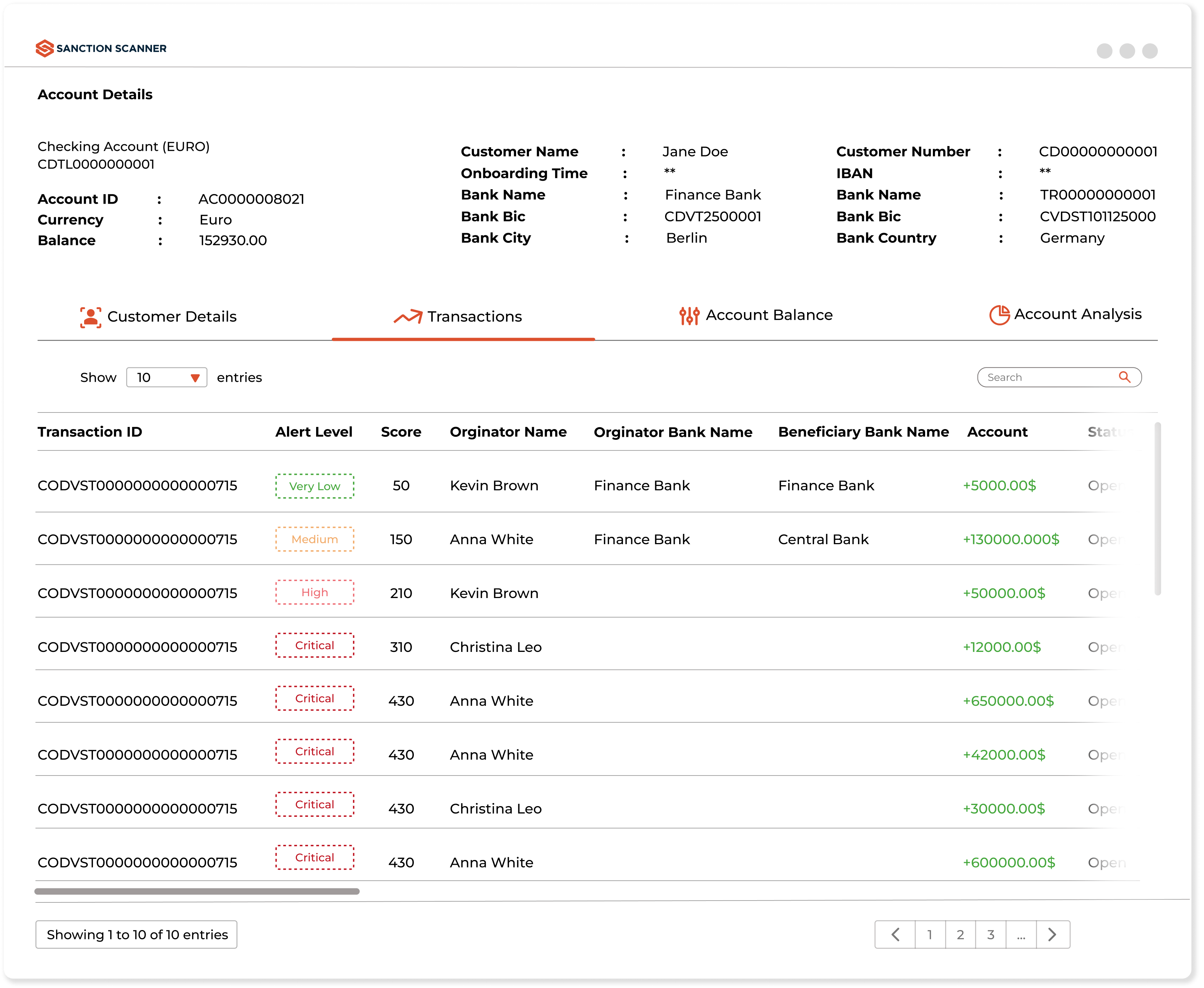

Suppose you have determined the criteria as we have explained above, and a scorecard profile will be created for each customer according to these criteria. These risk scores are included in the customer's Profile. You can also see risk scores within the Customer Profile and sections such as Customer Details, Accounts, Transactions, and Balances. The purpose of all this Customer Profile is to know the customer and understand the potential risks etc., that may occur in customer transactions. Through Sanction Scanner's user-friendly interface, you can understand this data very easily.

Suppose you set criteria such as Job, Married Status, Annual Income, Nationalities Count, Citizenship, Children Account for any customer who will return to our case. You can now score these criteria based on the current status of your customers. You know that you are an engineer for the job and you give 30 scores. For married status, you give 100 scores. For Children Count you give 10 scores for each child and a total of 30 scores for 3 children. You give 100 scores for 2 scores in Nationalities Count. Annual income is over 5000 euro you gave 200 scores. Finally, at Citizenship, you gave 500 scores for your customer are from Finland. AML Transaction tool calculates the customer's Total Scope based on all these criteria and scoring; for example, the score is 960 according to this case. As a result, you can easily determine whether or not to do business with these people or the way you do business based on the scores of each customer.

Sanction Scanner AML Transaction Monitoring can offer you the most suitable and dynamic solutions for your business. You may think that the Transaction Monitoring process is difficult, but our team is always with you, and you can take a look at our product by requesting a demo.