Digital banking refers to the use of technology to provide financial services, including basic banking operations like bill payment and account transfers, as well as more advanced services like personalized money management and loan applications. It can be offered by traditional banks through their websites or mobile apps, or by digital-only banks that operate entirely online.

Current State of Digital-Only Banks

Digital-only banks, also known as neobanks , have gained popularity in recent years due to their ability to meet the demands of tech-savvy consumers. It is estimated that there will be nearly 40 million neobank account holders by 2025.

The digital transformation of banking was driven in part by consumer demand for more convenient ways to access financial services outside of traditional branches. It has also been influenced by the rise of banking-as-a-service (BaaS), in which traditional banks open up their infrastructure and consumer data to third-party providers and fintechs to develop new digital services. The UK has already passed BaaS and open banking regulation, and other countries are expected to follow suit.

Digital banking has the potential to streamline and automate many aspects of the banking industry, including back-end operations and administrative tasks. It also allows banks to better serve customers through personalized services and more convenient access to financial accounts. However, it is important for banks to prioritize security and privacy as they adopt digital technologies, as the digitalization of financial services also brings with it new risks and challenges.

Some examples of top digital banking companies in the financial services industry include U.S. Bank, which is known for its customer service features and Citi, which offers a range of digital money management services. Zelle is another digital banking provider that has been widely adopted by financial institutions in the US to facilitate real-time peer-to-peer payments.

About KYC Checks

Know Your Customer (KYC) is a part of the AML process that involves organizations verifying the identities of their customers. The KYC process should occur during the onboarding process to ensure that clients are truthful about their identities and business, and it should also occur throughout the commercial relationship to ensure that a customer's risk profile remains consistent with the company's information about them. The relationship between AML programs and the KYC process should be one of continuous feedback, with KYC helping to customize an AML program to the specific needs of a firm and improving compliance performance. Firms may use specialized KYC software to handle the identity verification process and automatically prioritize high-risk customers.

How KYC Checks Work in Banking

The process of Know Your Customer (KYC) and Anti-Money Laundering (AML) has become increasingly complex and costly for financial institutions, requiring large teams and significant time and resources to carry out basic data capture and analysis. However, a shift towards technology is beginning to take place as banks seek to create efficiencies, lower costs, and enhance decision-making while managing risk. Data from a survey of over 1,000 c-level executives across 150 corporate and institutional banks shows that financial crime risk is a top three investment priority for 45% of respondents, after cyber risk (49%) and operational risk (42%). The consequences of not having adequate KYC and AML processes in place can be severe, including costly fines and damage to a firm's reputation.

The KYC review process is particularly time-consuming for firms serving corporate customers, with 40% of surveyed banks saying it takes 31 to 60 days to complete a single review. The costs of KYC are also significant, with two thirds of survey respondents saying a review costs between $1,501 and $3,500. For banks that may be onboarding tens of thousands of clients every year, KYC costs alone can reach millions of dollars. The ongoing burden of managing periodic KYC reviews is also expensive and time-consuming for many firms, with 31-50% of review tasks being conducted manually for 41% of respondents.

The use of technology to automate and streamline the KYC and AML process offers a range of benefits, including reduced costs, improved efficiency, and enhanced risk decision-making. There are a number of technology solutions available, including KYC utilities, KYC as a service, and artificial intelligence (AI)-powered KYC platforms. These solutions can help firms to reduce their reliance on manual processes, increase the speed and accuracy of KYC reviews, and better manage their risk exposure. As the financial industry continues to evolve, the adoption of technology to streamline the KYC and AML process is likely to become increasingly prevalent.

Carrying Out KYC Checks and AML Compliance for Digital-Only Banks

Like many financial institutions, digital-only banks are under increasing pressure to comply with AML and KYC regulations, which require them to verify the identities of their customers. However, the use of personally identifiable information (PII) and knowledge-based authentication (KBA) for identity verification has become less secure due to large-scale data breaches, such as the Equifax breach. As a result, the risk of fraud has increased, with reported suspicious transactions and suspicious new account openings rising from 669,000 in 2013 to almost 1 million in 2016. In addition, new account fraud increased 40% in 2016, with over 1.8 million consumers having a new bank or credit card account opened without their knowledge. Fines for non-compliant financial institutions have also been increasing significantly, with the U.S. government fining banks over $15 billion between 2016 and 2017.

To comply with AML and KYC regulations and avoid fines, digital-only banks are required to perform various identity verification measures, including verifying the account owner's identity, obtaining information about the purpose and nature of the business relationship, and analyzing transactions to ensure they are consistent with the institution's knowledge of the customer and their risk profile. Other aspects of the KYC process include background checks and ongoing monitoring of the customer's activities. However, these measures can be time-consuming and inconvenient for customers, who may prefer to sign up for new accounts through digital channels.

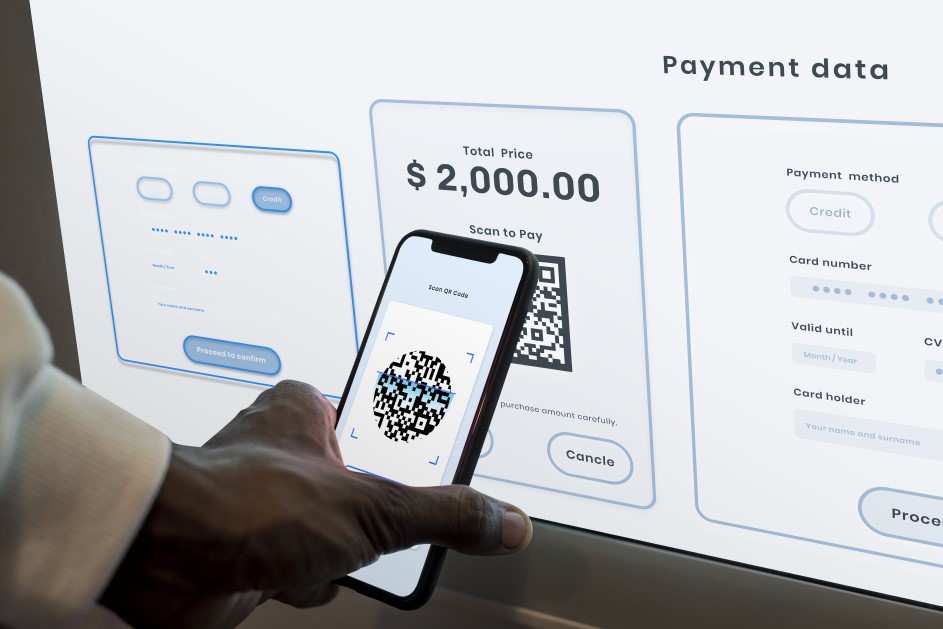

To address this issue, digital-only banks are turning to digital identity verification solutions that allow them to verify identities quickly and easily while still complying with regulatory requirements. These solutions often use biometric data, such as fingerprints or facial recognition, to confirm the identity of the customer, and may also include additional security measures such as two-factor authentication. By using digital identity verification, digital-only banks can provide a convenient and secure experience for their customers while also meeting regulatory requirements.

Sanction Scanne r is eager to help you with any upgrades to your KYC and AML Compliance systems. Contact us or request a demo; and we will make sure that these upgrades are made in the best way possible.